2024 has been a rough ride for the bike industry. Dealers, brands, and suppliers alike have been tossed around by economic headwinds, shifting consumer behavior, and an increasingly crowded market. Some have stumbled, and a few have outright fallen. What does this mean for 2025? Well, like any endurance ride, it’s going to take strategy, grit, and some smart moves to cross the finish line intact.

Let’s break it down.

The Shakeout: Who’s Left Standing?

The e-bike industry has lost some big names recently. Fermetco (selling iGo) hit receivership. Juiced Bikes is out of juice, declaring bankruptcy. Even juggernauts like Stromer and Yamaha have retreated from the North American market. What’s left? A landscape filled with opportunity—but also caution signs.

The message is clear: Survival requires adaptability. Brands and dealers that can’t adjust to the volatility won’t make it through. But the flip side? For those who do, the runway is wide open.

Growth or Plateau?

Globally, the e-bike market is still growing. In Europe and Asia, it’s booming. But in North America, it’s a mixed bag. Sure, Canadian import data shows a fascinating story: imports skyrocketed from $131 million import in 2019 to a peak of $530 millions in 2022. But by 2023, they took a sharp dip to $360 million—a significant drop that signals a cooling-off period in the market. Pair this with consumer search trends (thanks, Google), which show flattening interest, and it’s clear the e-bike boom isn’t as straightforward as it once seemed.

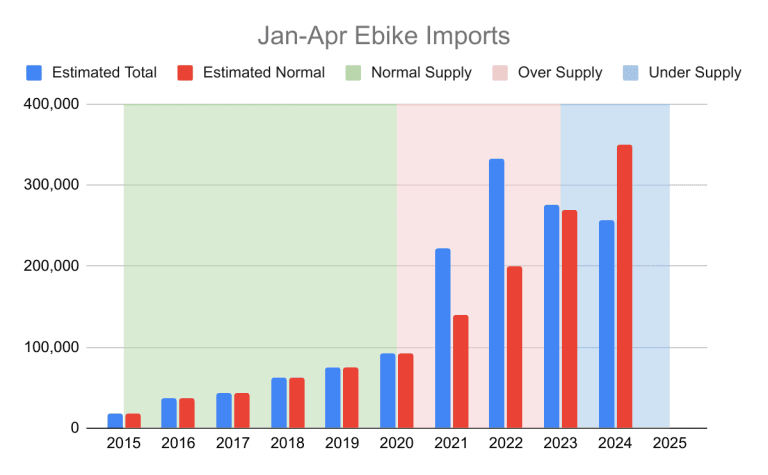

USA import data tells a familiar story. By 2023, the market hit the brakes, with e-bike sales sliding about 10% from their 2022 highs. Fast forward to January 2024, and the numbers dipped another 7.5% year-over-year. Why? Brands are playing it safe—tightening up imports and adjusting to an uncertain sales outlook after the inventory hangover of recent years. It’s a clear sign: the days of “import now, sell later” are over, replaced by a more cautious, strategic approach.

Source: https://www.research.bike/category/import-data/

What’s behind the slowdown? Inflation, rising interest rates, and post-COVID spending shifts. The pandemic-driven outdoor boom has waned, with wallets moving toward travel, dining, and other experiences. For dealers, this means it’s time to reframe the conversation: Less about “why e-bikes?” and more about “why your e-bike?”

The Good News

It’s not all doom and gloom. Inflation is easing, and interest rates are starting to cool. That means better financing options and more consumer confidence. And let’s not forget: Dealers are forecasting a solid 22% sales bump for 2025. The industry isn’t just surviving; it’s recalibrating.

The Competition Conundrum

The market is being pulled in two directions. On one end, budget-friendly imports—think sub-$1,500 bikes flooding in from China—are saturating the low-cost segment. On the other, high-end brands like Trek and Specialized dominate the $4,000+ range.

The real opportunity lies in the middle. Brands like ENVO Drive Systems are carving out a sweet spot in the $2,000-$3,000 range. It’s a space ripe for purpose-built bikes that balance performance, quality, and affordability. And that’s where dealers can really differentiate—offering value, not just price.

Selling Value, Not Discounts

The race to the bottom on price is a trap. Amazon e-bikes and liquidation deals from brands like iGo are flooding the market with cheap, disposable products. But low-cost bikes often come with hidden costs: poor quality, no after-sales support, and unhappy customers.

The better play? Focus on what sets you apart. Educate consumers about the features and benefits that make your bikes worth it. Build trust. Offer stellar service. A cheap deal might win the first sale, but quality and support create lifelong customers.

2025: The Pivot Point

Here’s the reality: The e-bike market in North America is maturing. The days of wild growth and new entrants are giving way to a shakeout. Bankruptcies will continue. Brands without a long-term strategy will fall away.

For those left standing, 2025 is the moment to solidify your position. The brands and dealers with the right business models, clear messaging, and forward-thinking strategies will emerge stronger. This is the year to decide: Are you in it for the long haul, or just along for the ride?

We’d love to hear from you. What are your thoughts on the state of the e-bike market? How are you preparing for the year ahead, and what challenges or opportunities do you see on the horizon? Drop a comment below and let’s keep the conversation rolling—together, we’ll navigate the road ahead.

Share:

Comment les vélos électriques certifiés UL2849 pourraient aider les détaillants de vélos à réduire leurs coûts d'assurance

Thermal Runaway in Lithium-Ion Batteries: Causes, Risks, and Prevention